Let’s talk about money

florestan

What Does Money Mean to You?

Let’s face it, talking about money isn’t easy. Most of us would rather avoid the topic until it’s too late, and when we finally have to, the conversations are rarely pleasant. That’s why I’m building CleverCash to help you get a grip on your expenses, avoid those awkward talks, gain insights, and maybe even save some money along the way :)

So, here’s a quick exercise. Answer this simple question: “What does money mean to you?”

Think about it, write it down, and take five minutes to reflect. Then, please come back and keep reading. Ready? Great. Here are my thoughts.

Freedom

You’ve probably heard the saying, “Money doesn’t buy happiness.” A smart person on the internet once clapped back with: “Oh yeah? Well, I’d rather cry in a Lamborghini than a Toyota.”

The internet always has the best comebacks.

While I don’t desire wealth just for the sake of it, and I have zero interest in luxury items, this sentiment does resonate with me. Outside of cameras and lenses, I don’t even have expensive hobbies. So, no, I can’t see myself diving into a vault of gold like Scrooge McDuck (don’t try this at home, kids!)

But what I do value is the freedom that comes from having my finances in order.

And that’s the key to how I think about money: freedom.

A Trip Down Memory Lane

I’m not a big Drake fan, but I do find myself quoting “Started from the bottom, now we’re here” quite a bit.

There’s a reason that line resonates with so many people. Success, whether in our careers, relationships, or finances, rarely happens overnight. It takes small, consistent steps. For me, financial literacy didn’t come naturally, and I had to learn the hard way how to build a sustainable relationship with money.

As a student, I barely thought about money at all. If I had anything left at the end of the month to buy an extra pack of ramen, I was happy. It wasn’t until I got my first real job that I started asking myself: Is there a better way than just hoping I have enough left for rent?

So, I started experimenting.

50/30/20

At first, I tried budgeting with the 50/30/20 rule. A method where you allocate 50% of your income to needs, 30% to wants, and 20% to savings.

While this got me started with building an emergency fund and taking the first steps towards paying down my student loan debt, I couldn’t stick with it. It felt too rigid, and life is unpredictable. I found myself frustrated by breaking everything down into neat little Excel buckets, so I shifted my focus to tracking my expenses instead.

Excel

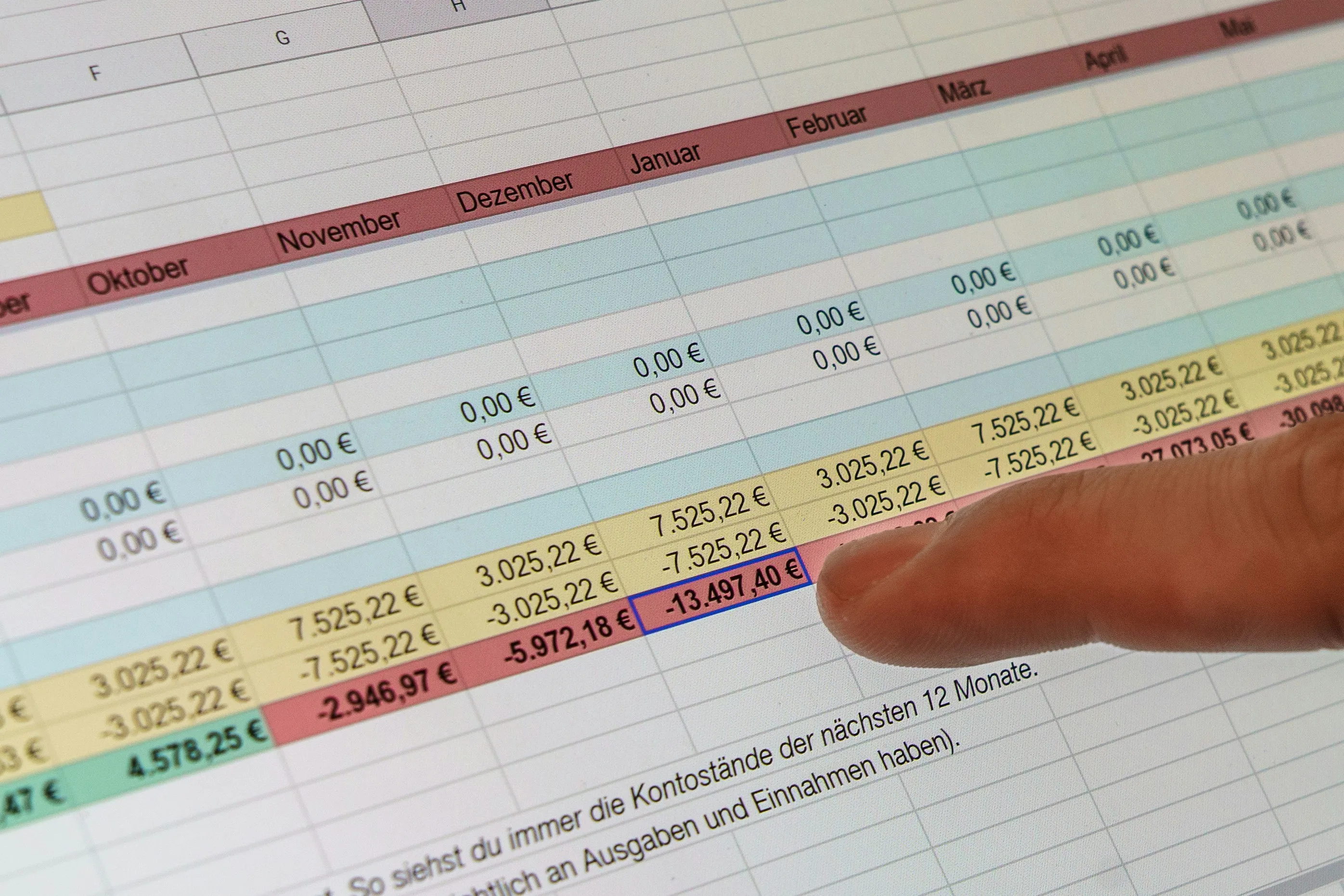

Many people use Excel to categorize expenses like Groceries, Transportation, Rent, etc. and that’s fine. For a while, it worked for me too.

But over time, I got tired of manually entering transactions, writing complicated formulas, and jumping between different templates. Eventually, I gave up tracking my expenses altogether.

Still, I couldn’t shake the feeling that there had to be a better way…one that didn’t require spending hours copying numbers into a spreadsheet.

So, I did what many developers do when faced with a tedious problem.

I wrote some code.

CleverCash — The Early Days

Automation was the only solution.

There was no way I was going to waste time manually copying transactions into Excel every month. So, I started writing scripts to streamline the process. Slowly but surely, my system evolved, turning into something far more powerful, intuitive, and robust than anything I had used before.

Along the way, I discovered all sorts of quirks in bank transactions.

For example, did you know that “SEPA iDEAL” and “iDEAL” are the same thing, just renamed over the years? It took me multiple debugging sessions to figure out why my categorization wasn’t working, but hey, at least now I know 😄

Life After Excel

The early version of my app transformed how I engaged with my finances.

Suddenly, my transactions felt like a personal diary, something I could check on my phone while commuting. I got a weird sense of satisfaction watching my spending categories fill up: Groceries, Transportation, Shopping… and, of course, Taxes, Fines, Student Loans…ugh.

And yet, every time I think my system has learned all my usual spending habits, I find some mystery transaction that leaves me scratching my head.

“When did I go to this café again?”

Oh, right! That was the day I handed in my keys and moved out of my old apartment. My girlfriend and I celebrated a new chapter in Amsterdam.

Funnily enough, we didn’t get champagne because the café didn’t serve alcohol before noon. But don’t worry, we made up for it later.

Thanks for reading

That’s the experience I want to give you with this app: a smooth, engaging, and clutter-free way to track expenses. Because getting a grip on your finances is already hard enough, I build tools to make your life easier.