Smart Savings on Autopilot

florestan

Introduction

In this article, I’ll show you how automating your savings can transform the way you build financial security. While understanding your spending patterns is the crucial first step toward financial peace of mind, creating a reliable safety net is what truly provides long-term stability. The good news? With the right approach, building this safety net doesn’t have to be complicated or stressful.

Remember that building good financial habits takes time. If you ever feel overwhelmed, take a break and return to your financial journey when you’re ready.

1. Understand Your Spending

By tracking your expenses, you gain clarity on where your money goes each month. This awareness is crucial for developing a sustainable approach to managing your finances.

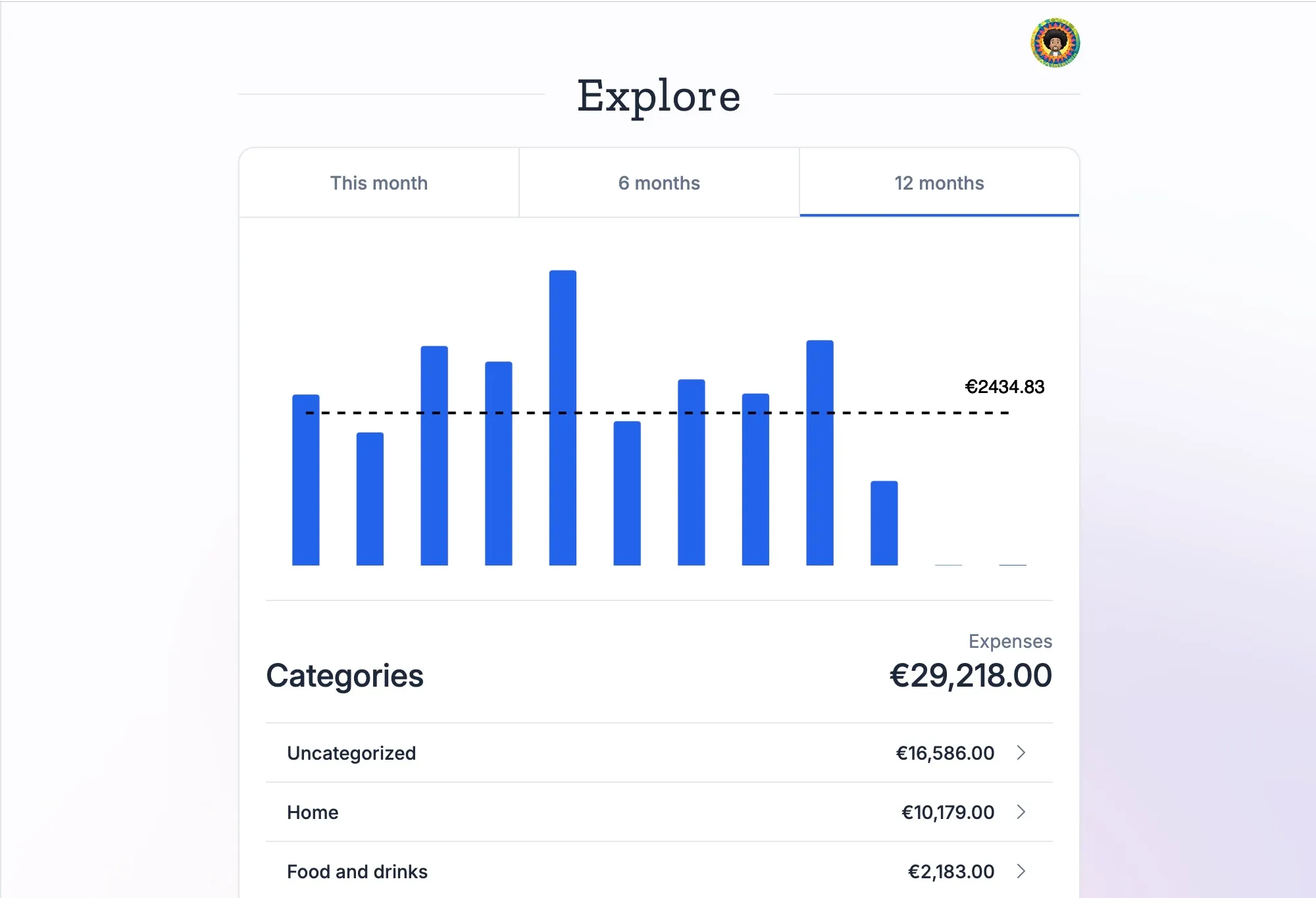

With CleverCash, you can easily see your spending patterns on the Explore page, complete with averages and trends that help identify your typical monthly expenditure.

Why this matters: Knowing your average monthly expenses gives you a baseline for how much you need to maintain your lifestyle, which is essential for planning your finances.

CleverCash advantage: Our app automatically accounts for transfers, reimbursements, and other factors that might skew your financial picture, giving you the most accurate view of your spending habits.

2. Separating Everyday Money from Savings

Once you understand your spending patterns, it’s time to separate your everyday money from your savings. This separation is crucial for building a financial safety net.

Many financial experts recommend having separate accounts for different purposes:

- Everyday spending account: For regular bills, groceries, and daily expenses

- Savings account: For your emergency fund and future goals

This separation creates a psychological boundary that helps protect your savings from impulsive spending. Or as I like to put it: You can’t spend money you don’t have :)

3. Creating Your Safety Net

Once you understand your monthly expenses, you can determine a realistic savings goal. For example, if you spend €2,000 per month, a common recommendation is to build an emergency fund covering 3-6 months of expenses (€6,000-€12,000).

CleverCash helps you track your progress toward this goal by giving you clear insights into your spending patterns and helping you identify opportunities to set money aside.

![]()

4. Automating Your Savings

Consistency is key when building your financial safety net. Setting up automatic transfers to your savings account removes the need for willpower and ensures you’re regularly setting money aside.

Most banks allow you to schedule recurring transfers. Consider setting one up for shortly after your regular income arrives. This way, you’re “paying yourself first” before everyday expenses can claim that money.

💡 Quick Start Tip

Want to start today? Set up an automatic transfer of just €25 to a dedicated savings account that happens the day after your salary arrives. Even this small amount builds momentum and creates the habit of saving consistently.

5. Getting Reliable Information

For trustworthy financial information specific to The Netherlands, resources like NIBUD and Wijzer in geldzaken offer valuable guidance on managing personal finances.

These resources can help you understand how your spending compares to national averages and provide general tips for improving your financial situation.

Conclusion

Building a financial safety net becomes effortless when you put it on autopilot. Automatic transfers create a system that consistently builds your savings, regardless of willpower fluctuations or busy schedules.

The steps we’ve covered like understanding your spending, separating your accounts, and automating transfers, create financial stability without the hassle.

Tools like CleverCash provide the spending insights you need to set realistic savings goals and help you track your progress.